Lessons from the Past and China: How Air Service Might Recover After the Pandemic

The COVID-19 pandemic is a global health crisis – tragically taking many lives. Actions to contain the pandemic have also had severe economic consequences – in the United States, economists now predict that second quarter 2020 Gross Domestic Product (GDP) will decline 10 to 35 percent.

According to Transportation Security Administration (TSA), daily passenger volumes in the USA are now down 90 to 95 percent from the same time last year and similar drops are being experienced elsewhere. Airlines have already announced service cuts for April that range from 40 percent (Southwest) to 80 percent (Delta) and some, like Spirit Airlines, have suspended all service to cities with severe outbreaks.

Insights from China, In the Beginning of Service Recovery

While it is difficult to anticipate the overall peak of the pandemic, the state of preparedness in anticipation for the eventual recovery is of the upmost importance. To gain a better sense of how this might look, we have examined the experiences of the cities of Wuhan and Hong Kong that were severely affected at the start of the pandemic. Wuhan was the epicenter for COVID-19 at the start of the pandemic. Hong Kong, while part of China, imposed travel restrictions with the rest of China early into the pandemic and had far fewer COVID-19 cases; hence, their economy was less damaged than the city of Wuhan.

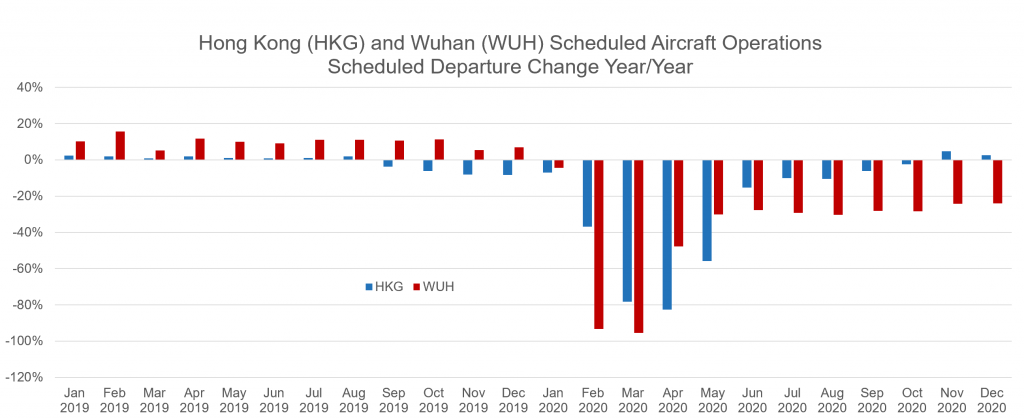

At the height of the slowdown, Wuhan experienced a 96 percent decrease in its daily departing flights and Hong Kong a 79 percent decrease. The reduction in passenger volumes are even more severe when last minute flight cancellations and lower load factors are considered. As shown in the illustration on the following page, air traffic activity is scheduled to rebound, albeit at a slower pace than occurred before the pandemic.

The carriers’ schedules indicate they plan to slowly add capacity back such that roughly half the reduction in February and March is back in service by May, followed by marginal capacity adds in subsequent months. As the virus has spread, other parts of the world have experienced similar trends. Another observed trend is the operation of a “bare bones” schedule, with one or possibly two daily frequencies, rather than eliminating service on many routes/cities.

It is expected that many parts of the world will generally follow similar trends resulting in drastic cuts during the first two months of the pandemic followed by moderate improvement in the third. This expectation may need to be tempered in the U.S. due to the severity of the outbreak which could push additional capacity to June or July. Assuming that the worst of the pandemic is over by the middle of May, scheduled airline capacity for the month of July could be at 50-75 percent of levels flown prior to the pandemic. If this is not the case, it would be expected that these capacity additions would be delayed until a time at which the threat of the virus is reduced.

The Climb Back to Normalcy

The post-9/11 air service experience, specifically as it pertains to the New York City (NYC) market, may be a useful gauge of how the industry could react to the current crisis. While COVID-19 has severely affected the nation’s air service more than 9/11, it could be argued that COVID-19 has had a similar impact on the rest of the U.S. as 9/11 did on NYC.

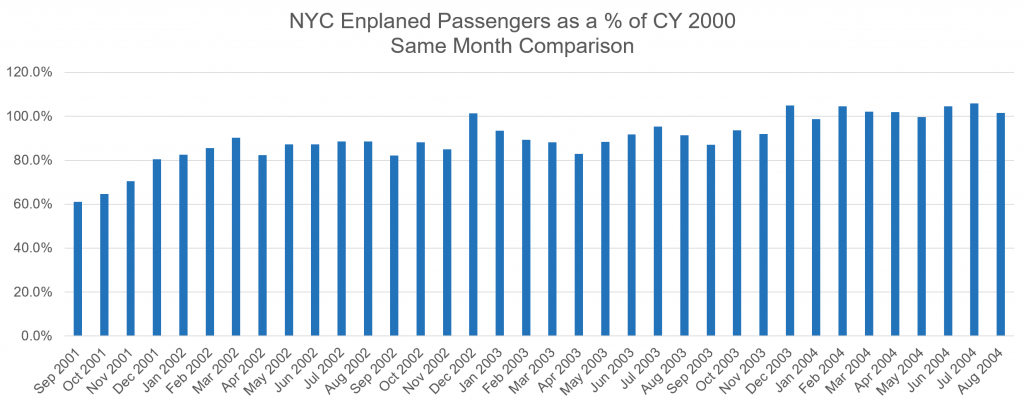

The following chart shows enplaned passenger traffic for NYC’s three major commercial airports, Newark Liberty International (EWR), John F. Kennedy International (JFK), and LaGuardia Airport (LGA) as a percentage of the same month for calendar year (CY) 2000. For example, passenger traffic for the month of August in the years of 2002, 2003, and 2004 are used as the numerator and are each separately divided by the passenger traffic in August 2000 which is the denominator. This approach factors out seasonality and shows how air travel demand has changed over time in NYC. Over a period of 12 months, NYC climbed back to about 80-85 percent of levels prior to 9/11. The full recovery period to pre-9/11 levels took three years.

Brief, Financial Questions Airports Need to be Asking

As a result of this downturn, U.S. airports are experiencing dramatic reductions of passenger-related revenues including those from airline landing fees, terminal concessions, rental cars, and parking. The Coronavirus Aid, Relief and Economic Security (CARES) Act (the Act) recently signed by the President on March 27, 2020 will provide $10 billion of much needed grants to help maintain cash flow and liquidity to relieve airports throughout the U.S. However, the longer the crisis continues, it is widely expected that airports will experience further pressure to maintain their financial viability.

- Similar to 9/11, airports throughout the U.S are now rapidly mobilizing to develop various financial strategies and response plans to reduce costs and remain financially solvent while maintaining operations and staffing levels through the COVID-19 crisis. There are financial questions that airports should be asking themselves in light of the current crisis and recently passed federal stimulus, here are several to consider:What will the impacts be from steep traffic declines be to the airport’s revenues, cash flow, and bond indenture rate covenants?

- Should airports provide rent deferrals and/or Minimum Annual Guarantee (MAG) relief to the airlines, concessionaires, rental cars, and other tenants, and if so, what are the implications of doing so?

- How will the COVID-19 crisis impact future airline negotiations for a new airline agreement or extension?

- What is the best way to use airport relief funds? Should they be used to supplement airport revenue, pay debt service, O&M expenses?

Of course, each airport is unique in how they address each of these questions. The exact strategies employed will depend on how each airport’s individual bond indentures are written and whether they employ a residual, compensatory, or hybrid rates and charges methodology.

Source: Innovata (via Diio)

Source: US DOT Report T-100

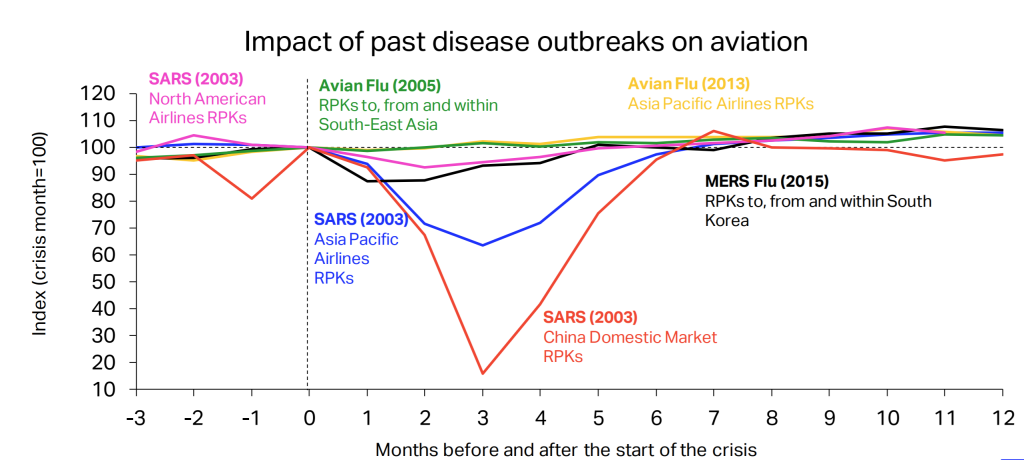

IATA has also prepared a comparison of how traffic bounced back during prior disease outbreaks. The most germane example is the SARS outbreak that inflicted China in 2003 noted in red below. This visual, consistent with COVID 19, depicts traffic initially dropped approximately 85 percent over three months returning to prior levels during the following three months, an almost perfect “V-shaped” recovery.

Our assessment is that traffic will not recover today like China did during the post-SARS time period. SARS was generally restricted to China and the “lock down” was able to keep the disease isolated allowing it to end quickly. COVID-19 on the other hand has quickly spread throughout the world and will have a much greater global economic impact than SARS and will likely have a more lasting impact upon air travel demand. Finally, COVID-19 appears to be much more communicable and deadly than SARS which may result in greater reluctance from passengers to fly.

Conclusions

While these examples give some guidance as to future air travel expectations, it is very difficult at this time to gauge the timing of the recovery and how the traveling public will react.

It is reasonable to conclude that it will take several months for the initial recovery, followed by possibly several years until air travel demand returns to levels seen before the crisis. Air service in the U.S. will initially return to 50-75 percent of prior levels, hopefully by sometime later in the summer of 2020. Excluding China, other countries will likely see air service return at a slower rate. Going forward, our insight indicates traffic growth will largely be driven by economic growth and the willingness of the public to travel by air again.

Carrier choices will evolve differently in different parts of the world. The U.S. airlines may be less affected than their international counterparts due to their financial position. In Asia for example, significant airline consolidation may occur.

Factors indicate domestic travel will bounce back quicker than international travel, particularly in the U.S. Additionally, leisure travel will likely recover much more quickly than corporate travel. It is possible that corporate travel demand may be reduced for an extended period, due to the economic impact, aided by the use of new communication technologies that have been “discovered” during this crisis.

The gap between the growth rates of low cost carriers and network airlines will further widen. In part tied to this, it is likely that lower air fares will be prevalent, particularly in the near-term.